Loan to value calculator for heloc

You may be able to convert some or all of the balance you owe on a variable-rate HELOC to a fixed-rate loan. To calculate your LTV rate simply.

How To Calculate Equity In Your Home Nextadvisor With Time

For example a 30.

. Key in the amount owed on your mortgages Press Calculate LTV to see the results. A home equity loan calculator is a good way to start exploring price options for tapping the equity in your home. Maximum loan amount for primary residences is 1000000.

A HELOC operates similar to a credit card in. Once the borrowing period ends youll repay the remaining balance on your HELOC with interest just like a regular loan. Lenders will typically allow homeowners to borrow anywhere from 70 to 85 of the value in their home.

Typically lenders will only approve a home equity loan or HELOC with an LTV ratio or CLTV ratio of up to 85 percent meaning you have 15 percent equity in your home. It allows home owners to borrow against. For line amounts greater than 100000 maximum combined loan-to-value ratios are lower and certain restrictions apply.

For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home. Best home equity loan rates in September 2022. HELOC Payments How are HELOC repayments structured.

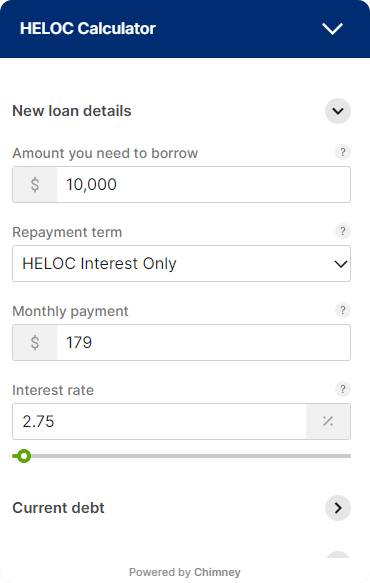

Simply enter the amount you wish to borrow the length of your intended loan vehicle. Shows total interest paid. A fixed amount of money you borrow for a fixed amount of time secured by your home.

Loan to Value LTV Calculator. Home equity loans are similar to personal loans in that the lender issues you a lump sum payment and you repay the loan in fixed monthly installments. Car Depreciation Calculator.

Calculate the equity available in your home using this loan-to-value ratio calculator. The amount you owe on outstanding home loans divided by the market value of your home is considered the combined loan-to-value ratio. The loan is a lump sum and the HELOC is used as needed.

Most HELOC providers allow you to borrow up to a maximum of 85 of the value of your home minus the amount you owe. At this point the Mortgage APR Calculator will show the monthly payment for the loan amount term and interest rate you have entered. Choose the right currency if needed Input an estimate of your property value.

The ratio of the amount borrowed to the value of the home is called loan-to-value or LTV. The installment loan calculator exactly as you see it above is 100 free for you to use. HELOC vs Home Equity Loans.

Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home. The HELOC repayment is structured in two phases. Adjustable in most cases Fixed.

A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt. A 900000 home with a 5 interest rate for 30 years and 45000 5 down requires an annual income of 218403. In addition lenders will also take a look at your employment history credit score and history monthly income and expenditure and any other debts you may have.

Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan. Choose Annually or Monthly for Report Amortization This will not affect your results on this page but will determine how your amortization schedule will be shown on the following page after you click. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost.

The rates shown above are calculated using a loan or line amount of 30000 with a FICO score of 700 and a combined loan-to-value ratio of 80 percent. It also generates a normal curve and shades in the area that represents the p-value. Home equity loans are just like a traditional conforming fixed-rate mortgage.

Prior to the passage of the Tax Cuts and Jobs Act of 2017 interest on up to 100000 of second mortgage debt via home equity loans or HELOCs was tax deductible no matter how the money was used. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. The draw period is the phase.

Our Simple Excel loan calculator spreadsheet offers the following features. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. You can compute LTV for first and second mortgages.

Understanding the Income Tax Implications of Tapping Home Equity. Microsoft Excel Loan Calculator Spreadsheet Usage Instructions. Home Equity Loan Calculator.

Loan Type Home Equity Loans HELOC Cash Out Refi. The calculator will then reply with an income value with which you compare your current income. Click the Customize button above to learn more.

The remaining total is the amount of equity you. This p-value calculator helps you to quickly and easily calculate the right-tailed left-tailed or two-tailed p-values for a given z-score. For lines up to 100000 we will lend up to 80 of the total equity in your home.

Redmond Active Duty Military Members Veterans May Qualify for a 0 down VA Loan. How much do I need to make for a 900000 house. The lender also may freeze or reduce your line of credit if the value of the home declines significantly below the appraised amount or the lender reasonably believes you will be unable to make your payments due to a.

Home Equity Loan. You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. Allows extra payments to be added monthly.

They require a set monthly payments for a fixed period of time where a borrower is lent a set amount of money upfront and then pays back a specific amount each month for the remainder of the loan. On August 1 2019 Ginnie Mae announced they were lowering the loan-to-value limit on cash out refinancing loans to 90 LTV. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance.

The repayment period is usually 10 or 20 years. Previously the limit was 100. The calculator updates results automatically when you change.

Maximum loan amount for secondvacation homes is 500000. Why its important.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Qualification Calculator

Home Equity Loans Selco

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Macu

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Line Of Credit Heloc Home Loans U S Bank

Home Equity Loan Calculator Nerdwallet

How To Calculate Your Loan To Value Ratio Finder Com

Heloc Calculator

Looking For A Heloc Calculator